Ex-Google/Ex-Facebook/Ex-Husband TechLead accused of Pump and Dump scheme... (as a millionaire)

Patrick Shyu’s channel, Techlead on YouTube, has come under fire with accusations of engineering a multi-million dollar pump and dump scheme. …

A lot beginner crypto investors are often confused by the term “market cap ” when they are starting trading in Crypto. It is a term that is used frequently within the blockchain industry and it is a metric that allows investors to asses the size of a cryptocurrency.

Market Capitalisation is a term that originally came from the stock market. Market cap is a value that represents the market price of a cryptocurrency.

Market cap is used to measure the value of a certain cryptocurrency.

No matter what your metric of choice might be, market cap should always be considered when making investment decisions in the crypto space.

Investors use market cap to provide a more complete picture of a crypto and it is used to compare value across cryptocurrencies. It can be an indicator as to the growth potential of a cryptocurrency, and the relative safety aspects as compared to other cryptos.

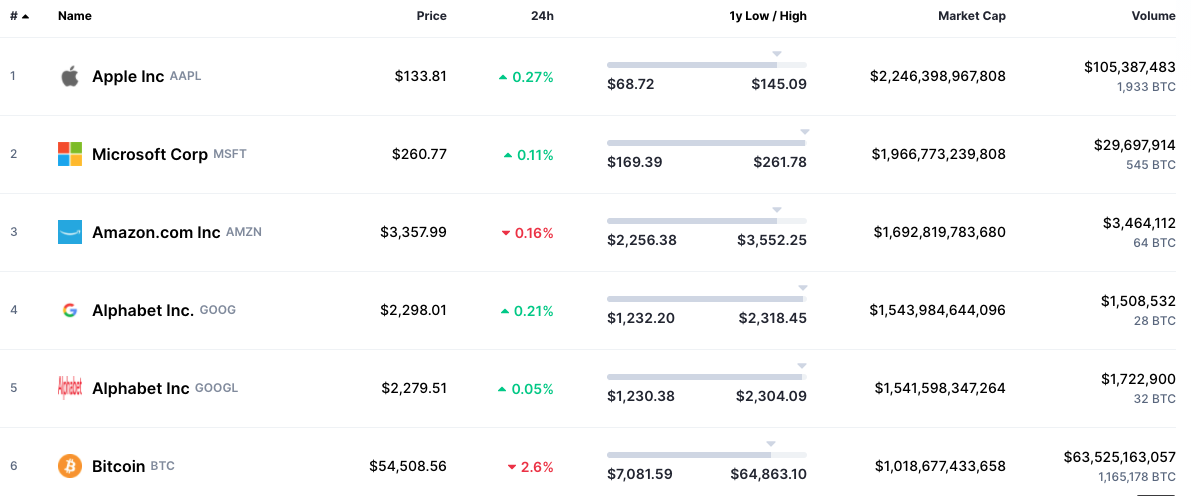

Bitcoin’s Market Cap in 2021 is approaching the market cap of companies like Google, Amazon & Apple. This is incredible growth for a digital asset that is only 12 years old. This is one of the reasons that investors have come to term Bitcoin as “Digital Gold”. Gold’s Market Capitalisation of $11 Trillion, it seems likely that one day Bitcoin will surpass this as it is a portable, secure digital asset with a limited supply.

Ray Dalio and Paul Tudor Jones have both compared Bitcoin’s rise with Gold. Clarifying his public comments on Bridgewater.com he said:

“I believe Bitcoin is one hell of an invention.” - Ray Dalio

Luckily it is easy to calculate the Market Cap. The market cap of a cryptocurrency is determined by the current price multiplied by the circulating supply:

Market Cap = Price * Circulating Supply

E.g. if there are If there are 10 million coins in circulation and if its current price per coin is $1 then its total market cap is $10,000,000.

There are many crypto resources out there that can help provide useful aggregations of data. Some of the most well known websites are listed below and are very useful in assessing the value of a particular crypto currency.

To provide a fuller, real-time picture of how the cryptoasset sector is performing, Total Market Cap takes market data from a range of cryptocurrencies — including Bitcoin and Ethereum.

The total supply is the maximum number of coins or tokens that can exist. This does not include coins already in circulation or reserved for other purposes such as airdrops, rewards etc.

Total Supply is the circulating supply as well as the coins that have not in the open market.

When Coins or tokens are burned, the total supply of a coin or token will be reduced forever.

Bitcoin currently has a limited 21 million coins limit due to its deflationary design (which means new bitcoin cannot enter the system).

Cryptocurrencies with market caps between $1 billion and $10 billion are considered mid-caps, while those below $1 billion are categorized as small-cap. Smaller companies in the cryptocurrency world have a higher risk of failure – but also stand to make more money if they succeed.

While market cap is certainly a good indicator of performance and how valuable a cryptocurrency is you need to take more than just this one factor into account when investing in Crypto. The crypto market is a fast changing environment, and thorough research is necessary to make the most well informed judgements.

Patrick Shyu’s channel, Techlead on YouTube, has come under fire with accusations of engineering a multi-million dollar pump and dump scheme. …

Enzyme Finance was formerly known as Melon Protocol. Enzyme (MLN), wants to make it easier for anyone with a computer and internet access the ability …